what is maryland earned income credit

Ad Explore detailed reporting on the Economy in America from USAFacts. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

Maryland State Tax Updates Withum

Ad Avoid Confusion Claim Your Earned Income Tax Credit With Our Easy Step-By-Step Process.

. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Have a valid Social Security. Ad Guaranteed maximum refund.

It can reduce the amount of taxes you. The bills purpose is to expand the numbers of taxpayers to whom the. To qualify for the EITC you must.

DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. See Marylands EITC information page. The Earned Income Tax payoff is a tax break or possibly even a refund of up to 6700 for those who qualify.

As part of the American Rescue Plan many parents and guardians are eligible for the Child Tax Credit and many people are eligible for the Earned Income Tax Credit. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The reason this tax credit is named after earned.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Earned Income Tax Credit EITC Rates. 28 of federal EITC.

The Earned Income Tax Credit also known as the EITC or EIC is a refundable tax credit for American workers earning low to moderate income. If you qualify for the federal earned income tax credit and claim it on your federal. Get your refund faster with free e-filing and direct deposit straight to your bank.

Does Maryland offer a state Earned Income Tax Credit. Claim Your Earned Income Tax Credit And Search Hundreds Of Other Deductions. The state EITC reduces the amount of Maryland tax you.

The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. 50 of federal EITC 1. The Earned Income Tax Credit EIC or EITC is a tax credit designed for taxpaying workers who make a low to moderate income.

Ad Avoid Confusion Claim Your Earned Income Tax Credit With Our Easy Step-By-Step Process. E-File directly to the IRS. In 2019 25 million taxpayers received.

Claim Your Earned Income Tax Credit And Search Hundreds Of Other Deductions. Have worked and earned income under 57414. Have investment income below 10000 in the tax year 2021.

Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. The state EITC reduces the amount of Maryland tax you. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

It all depends on how much you earned in 2021 and the size of your. Visualize trends in state federal minimum wage unemployment household earnings more. If you qualify you can use the credit to reduce the taxes you owe.

Depending on an individual workers circumstances a states Earned Income Tax Credit could add 3 to the value of their federal credit in Montana or double the credit for.

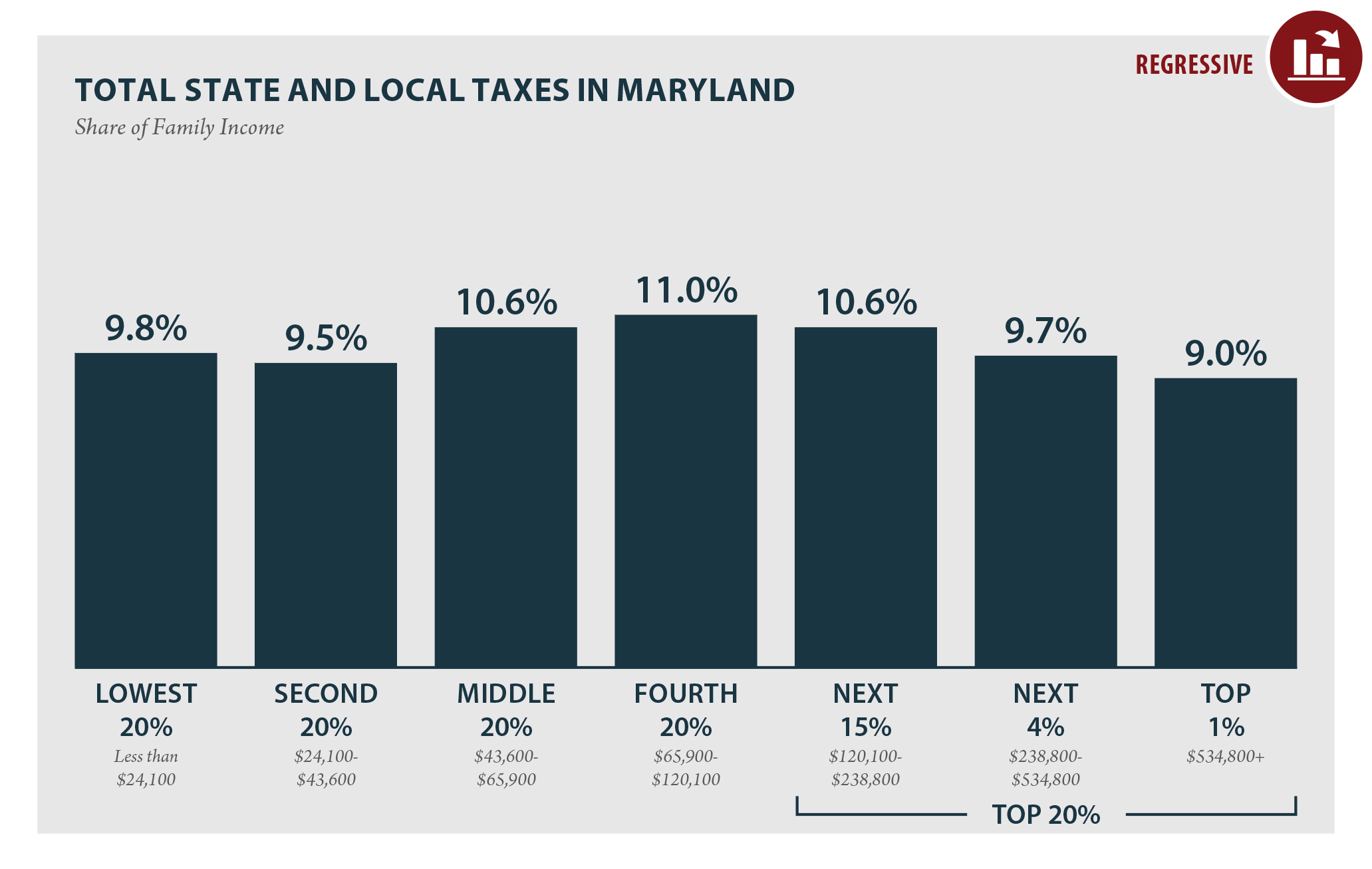

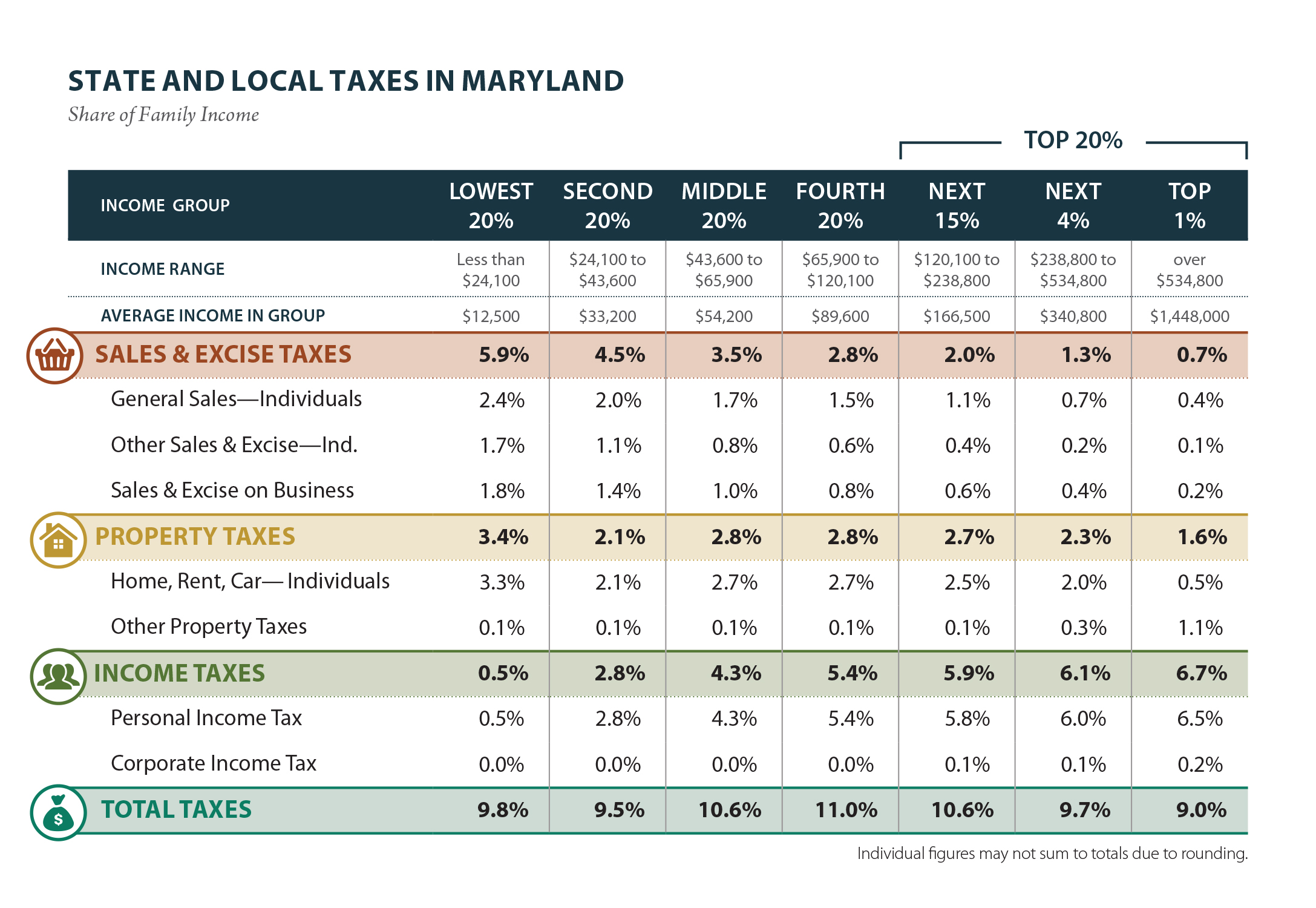

Low Earners Paying More In Taxes Than The Well Off In Maryland Maryland Center On Economic Policy

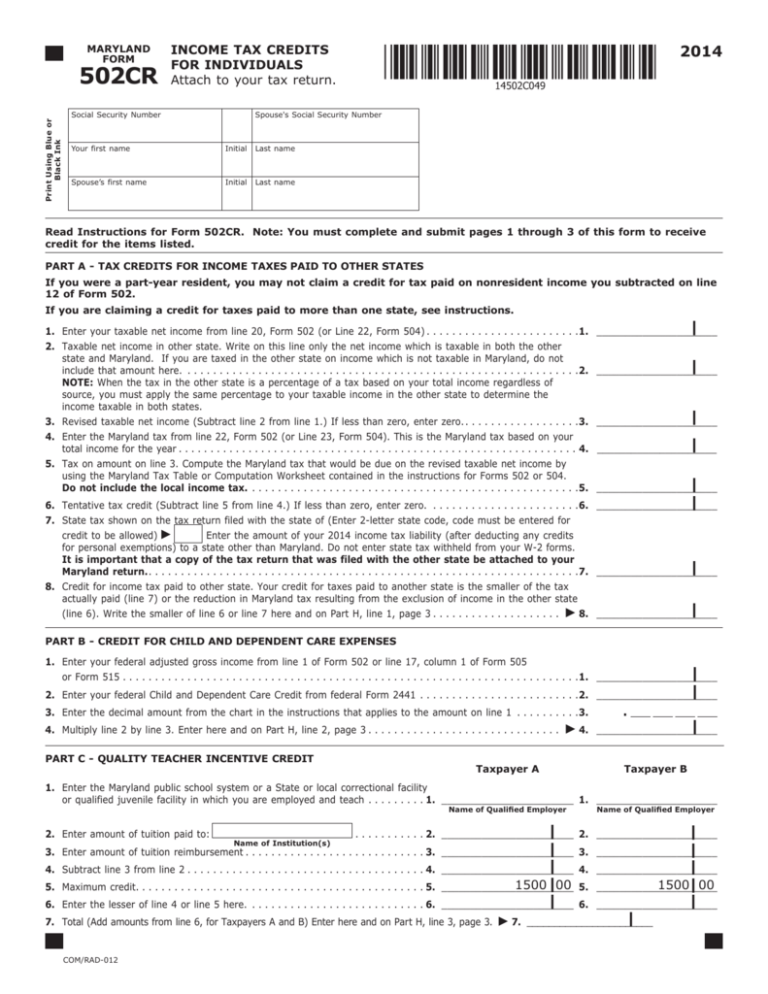

502cr Maryland Tax Forms And Instructions

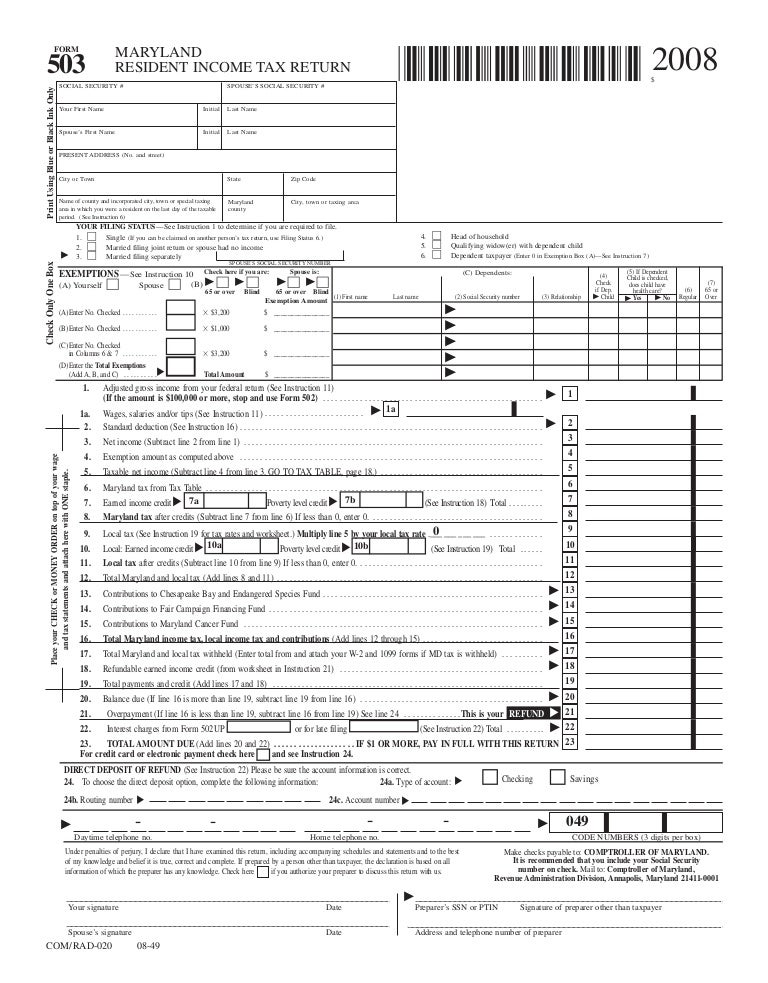

If You Are A Maryland Resident Maryland Resident Income Tax

Pin On United States Of America

Tax Day Our Shared Investments In Maryland Maryland Center On Economic Policy

Received A Notive Of Adjustment To Maryland Income Tax Return Don T Have Any Idea What Any Of It Means R Tax

If You Are A Maryland Resident You Can File Long Form 502 Or You May

Rules For The Maryland State Income Tax Subtraction Modification For 2020 Maryland State Firemen S Association

Prepare And Efile A 2021 2022 Maryland State Income Tax Return

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pin By Danny Claudia Membreno On Taxes Income Tax Income Tax

If You Are A Maryland Resident You Can File Long Form 502 Or You May

Revised Maryland Individual Tax Forms Are Ready

Maryland Who Pays 6th Edition Itep

Maryland State 2022 Taxes Forbes Advisor

Maryland Who Pays 6th Edition Itep

Need Proper Attention While You Doing Audit Of Financial Statements Under Us Gaap Financial Statement Audit Financial

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Lying About Your Earned Income Just So You Score An Earned Income Tax Credit May Backfire Badly Like Consulting Business Tax Credits Tax Preparation Services